Yes, you can get a loan to help cover the costs of surrogacy.

While surrogacy can be expensive—often ranging from $80,000 to over $150,000—many intended parents explore financing options, including personal loans, specialized fertility financing, or even home equity loans to help make their dream of parenthood a reality.

Why Consider a Loan for Surrogacy?

Surrogacy is a beautiful journey, but it’s also a significant financial commitment. Costs often include:

- Agency fees

- Legal and medical expenses

- IVF procedures

- Surrogate compensation

- Insurance and other unexpected costs

Since most health insurance plans do not cover surrogacy-related expenses (especially surrogate compensation and agency fees), intended parents often seek alternative financing solutions.

More: How Much Does Surrogacy Cost with Insurance in Texas?

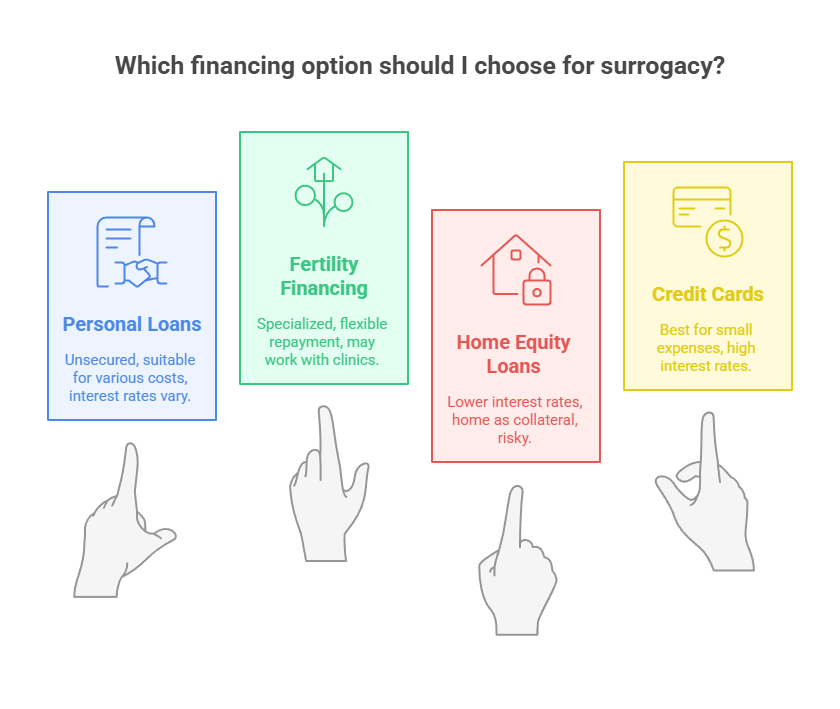

Types of Surrogacy Loans and Financing Options

- Personal Loans

- Offered by banks, credit unions, or online lenders

- Unsecured (no collateral required)

- Can be used for any surrogacy-related costs

- Interest rates depend on credit score

- Fertility Financing Companies

- Some lenders specialize in fertility or surrogacy loans (e.g., Future Family, CapexMD, Prosper Healthcare Lending)

- Often more flexible in terms of loan purpose and repayment plans

- May work directly with your clinic or agency

- Home Equity Loans or Lines of Credit (HELOC)

- Use your home as collateral

- Lower interest rates compared to unsecured loans

- Risk: Your home is on the line if you can’t repay

- Credit Cards

- Best for covering smaller or short-term expenses

- High interest rates make this less ideal for long-term financing

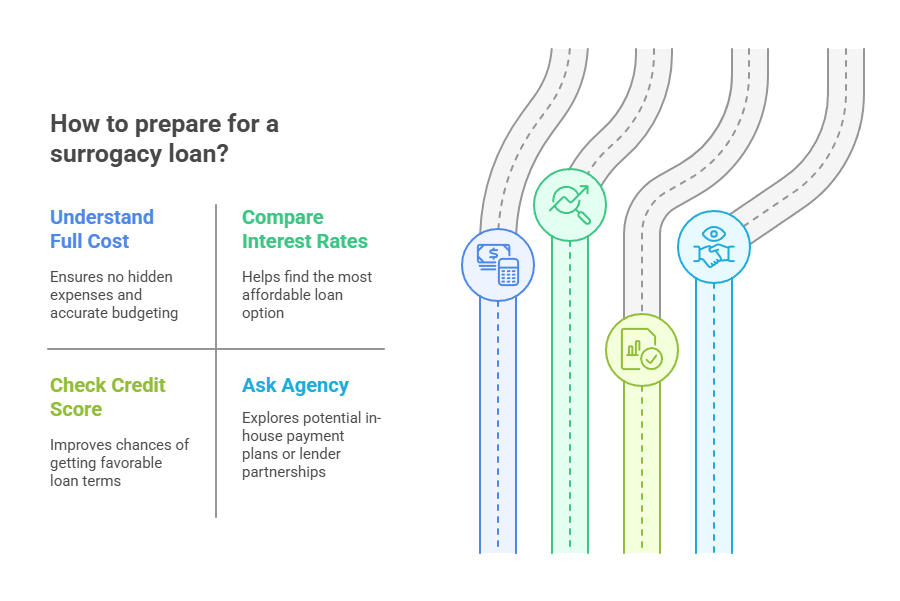

Tips Before Taking a Surrogacy Loan

- Understand the full cost: Get a clear estimate from your agency or clinic

- Compare interest rates: Shop around before committing

- Check your credit: Higher credit scores often mean better terms

- Ask your agency: Some agencies offer in-house payment plans or work with lenders

More: Finding a Surrogate Mother in Houston: A Step-by-Step Guide

Other Support Options

- Grants: Some nonprofit organizations offer fertility or surrogacy grants

- Crowdfunding: Platforms like GoFundMe are commonly used by families seeking financial support

- Employer Benefits: Some companies now include fertility support or surrogacy reimbursement as part of employee benefits

Final Thoughts

Taking out a loan for surrogacy is a big decision—but for many families, it’s a lifeline that brings them closer to parenthood. Just like the surrogacy journey itself, financing it requires careful planning, support, and trust in the process.