Surrogacy is a deeply personal and life-changing journey—but let’s be honest, it’s also a significant financial commitment. One of the most common questions intended parents ask is: “Can insurance help reduce the cost of surrogacy?”

If you’re exploring surrogacy in Texas, this article will walk you through the average costs, what insurance may (or may not) cover, and how to plan ahead financially.

🧾 The Average Cost of Surrogacy in Texas

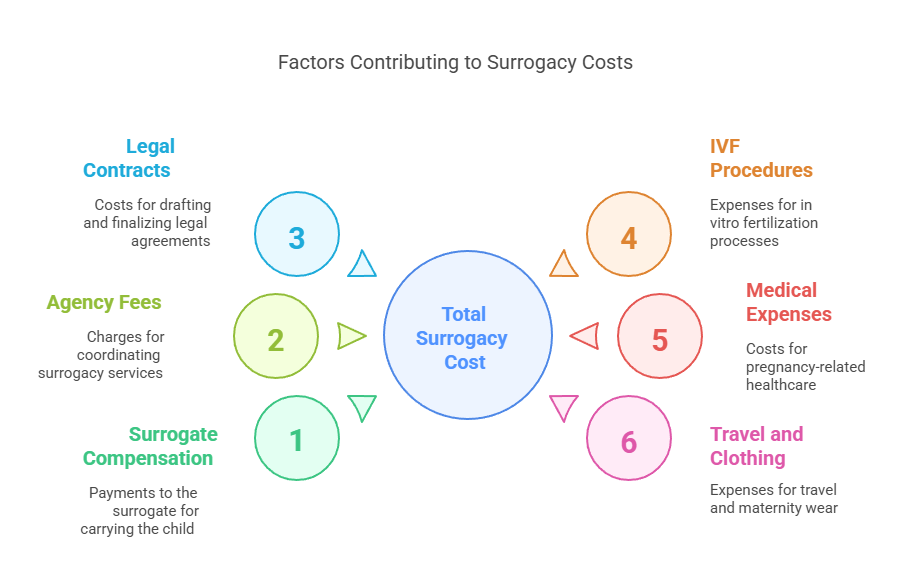

Without insurance, the total cost of a surrogacy journey in Texas typically ranges from $100,000 to $160,000. This includes:

- Surrogate compensation

- Agency and coordination fees

- Legal contracts and parental rights

- IVF and embryo transfer procedures

- Pregnancy-related medical expenses

- Travel, maternity clothing, and monthly allowance

While Texas is often more affordable than coastal states, the final cost can still vary greatly depending on your situation, your surrogate’s needs, and medical outcomes.

How Much Does a Surrogate Cost in Texas? A Complete Breakdown

✅ What Costs Can Be Covered by Insurance?

The short answer: some—but not all. Here’s how it usually breaks down:

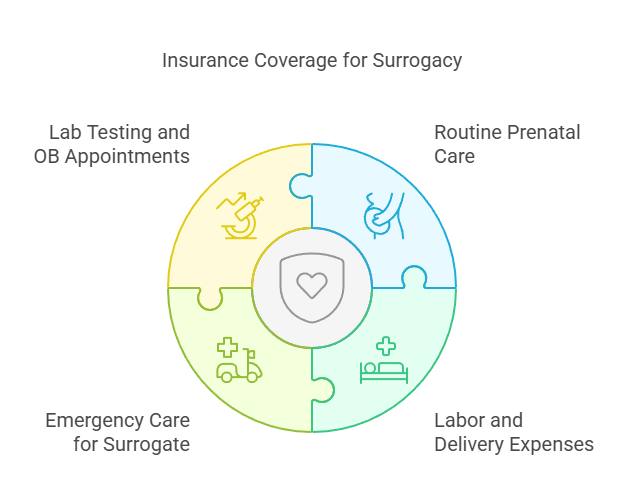

🏥 Typically Covered (Depending on Policy)

- Routine prenatal care

- Labor and delivery expenses

- Emergency care for the surrogate

- Some lab testing and OB appointments

These are only covered if the surrogate’s existing insurance does not have a surrogacy exclusion.

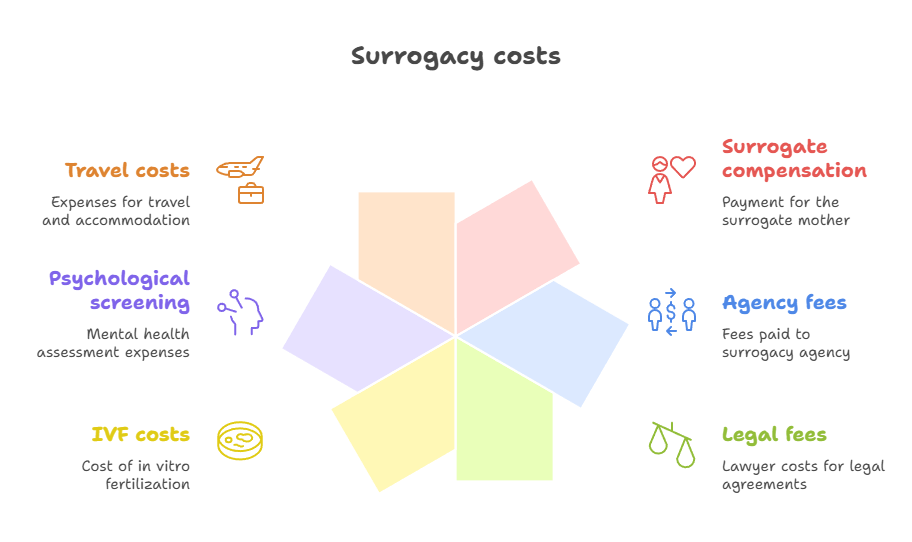

🚫 Not Covered by Most Insurance

- Surrogate compensation

- Agency or matching fees

- Legal fees for contracts or parentage

- IVF, egg retrieval, embryo creation

- Psych screenings and travel costs

🔍 How Does Insurance Actually Work in Surrogacy?

Insurance in surrogacy can be tricky. Here are key points to understand:

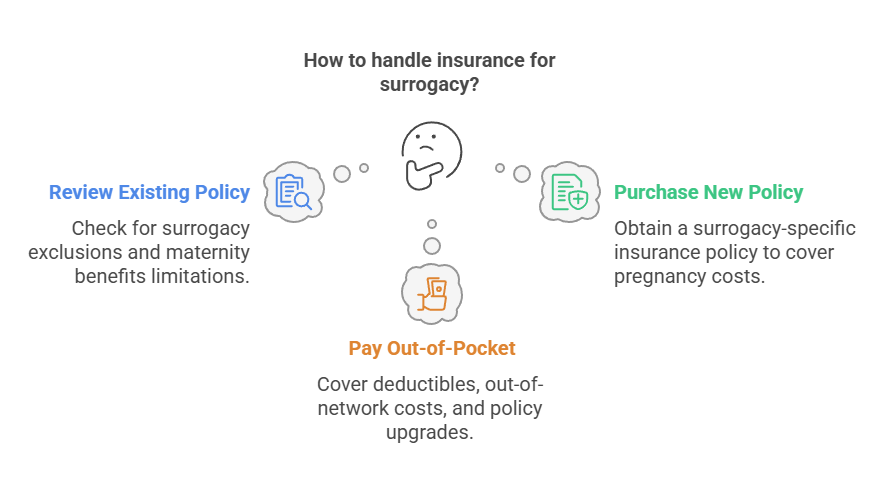

1. Review the Surrogate’s Insurance Policy

Many surrogates already have personal insurance. However, not all plans cover pregnancies where the baby is not biologically theirs. Look for surrogacy exclusions or “maternity benefits with limitations.” If excluded, a new policy may be necessary.

2. Purchasing Surrogacy-Specific Insurance

Some intended parents purchase a separate gestational carrier insurance policy to cover the pregnancy. These range from $12,000 to $30,000, depending on coverage level and provider.

3. Intended Parent Insurance Responsibilities

Even if some care is covered, intended parents usually pay:

- Deductibles

- Out-of-network costs

- Policy upgrades or rider additions

📊 Cost Breakdown: With vs. Without Insurance

| Category | Without Insurance | With Insurance |

|---|---|---|

| Medical & Delivery Costs | $25,000–$40,000 | $5,000–$15,000 |

| Total Estimated Budget | $130,000–$160,000+ | $100,000–$125,000 |

💡 With the right insurance setup, families may save $15,000 to $30,000—but only if planned in advance.

💡 Planning Tips for Intended Parents

- Start with an insurance review. Have a specialist or agency examine the surrogate’s plan for exclusions.

- Budget for a supplemental policy. Even if not required, it adds peace of mind.

- Don’t forget travel and post-birth care. Insurance rarely covers baby handover logistics or postnatal surrogate support.

- Work with an experienced agency. They can help guide the financial planning process and offer clarity on hidden costs.

📌 Final Thoughts

Surrogacy in Texas offers a beautiful blend of legal accessibility, experienced clinics, and relatively lower costs. However, insurance can make or break your budget—so the earlier you evaluate coverage, the better.